Excitement About Business Debt Collection

Some Of Business Debt Collection

Table of ContentsBusiness Debt Collection Can Be Fun For EveryoneExamine This Report about Business Debt CollectionNot known Facts About Personal Debt CollectionThe Best Strategy To Use For Personal Debt Collection

A financial debt collection agency is an individual or organization that remains in business of recuperating cash owed on delinquent accounts. Several debt enthusiasts are employed by firms to which money is owed by individuals, running for a flat charge or for a percent of the amount they are able to gather.A debt collector attempts to recover past-due financial obligations owed to lenders. Some financial debt collectors purchase delinquent financial obligations from creditors at a discount rate and also then seek to accumulate on their very own.

Financial obligation collection agencies who break the guidelines can be sued. At that factor the financial debt is stated to have gone to collections.

Overdue payments on bank card balances, phone costs, automobile finances, utility costs, as well as back tax obligations are examples of the overdue debts that a collection agency may be entrusted with fetching. Some business have their own financial debt collection divisions. But the majority of discover it easier to work with a financial obligation enthusiast to go after overdue debts than to chase the customers themselves.

International Debt Collection for Dummies

Debt collection agencies might call the individual's personal and job phones, and also even show up on their doorstep. They might likewise contact their family, good friends, and next-door neighbors in order to validate the get in touch with information that they have on documents for the individual.

m. or after 9 p. m. Nor can they incorrectly claim that a borrower will be jailed if they fall short to pay. Furthermore, a collector can't physically injury or intimidate a borrower and isn't permitted to take assets without the authorization of a court. The law also provides debtors certain civil liberties.

People that believe a financial debt collection agency has actually damaged the regulation can report them to the FTC, the CFPB, and also their state attorney general's workplace. They likewise can file a claim against the financial debt collection agency in state or government court. Yes, a debt collection agency may report a financial obligation to the credit report bureaus, yet just after it has actually gotten in touch with the debtor concerning it.

Both can stay on credit history records for up to seven years and also have an unfavorable impact on the person's credit report, a big portion my latest blog post of which is based upon their repayment background. No, the Fair Financial Obligation Collection Practices Act applies only to customer debts, such as mortgages, charge card, car lendings, pupil loans, and also clinical bills.

Everything about Debt Collection Agency

When that takes place, the internal revenue service will certainly send the taxpayer a main notification called a CP40. Because frauds are common, taxpayers ought to be wary of anybody claiming to be dealing with part of the IRS and talk to the internal revenue service to see to it. That depends on the state. Some states have licensing demands for financial obligation collectors, while others do not.

Financial debt collectors give a valuable solution to lenders as well as other creditors that intend to recover all or part of cash that is owed to them. At the very same time, the regulation provides certain customer defenses to keep financial obligation enthusiasts from ending up being as well hostile or violent.

Normally, this information is provided in a created notification sent out as the first interaction to you or within five days of their initial interaction with you, and it might be sent by mail or online.

This notice normally must include: A declaration that the interaction is from a financial debt enthusiast, Your name and mailing info, together with the name and mailing details of the debt collector, The name of the lender you owe the financial obligation to, It is feasible that even more than one lender will be noted, The account number related to the financial debt (if any kind of)A breakdown of the existing quantity of the debt that mirrors interest, costs, repayments, as well as credit reports since a particular date, The present amount of the debt when the notification is offered, Info you can utilize to respond to the financial debt collection agency, such as if you believe the financial debt is not yours or if the you could try this out amount is incorrect, An end date for a 30-day period when you can challenge the financial debt, You may see other information on your notice, however the info detailed over typically must be consisted of.

The International Debt Collection Statements

Discover more concerning your financial debt collection defenses..

When a financial obligation goes unpaid for a number of months, the original lender will certainly usually market it to an outside agency. The customer is known as a third-party debt collector.

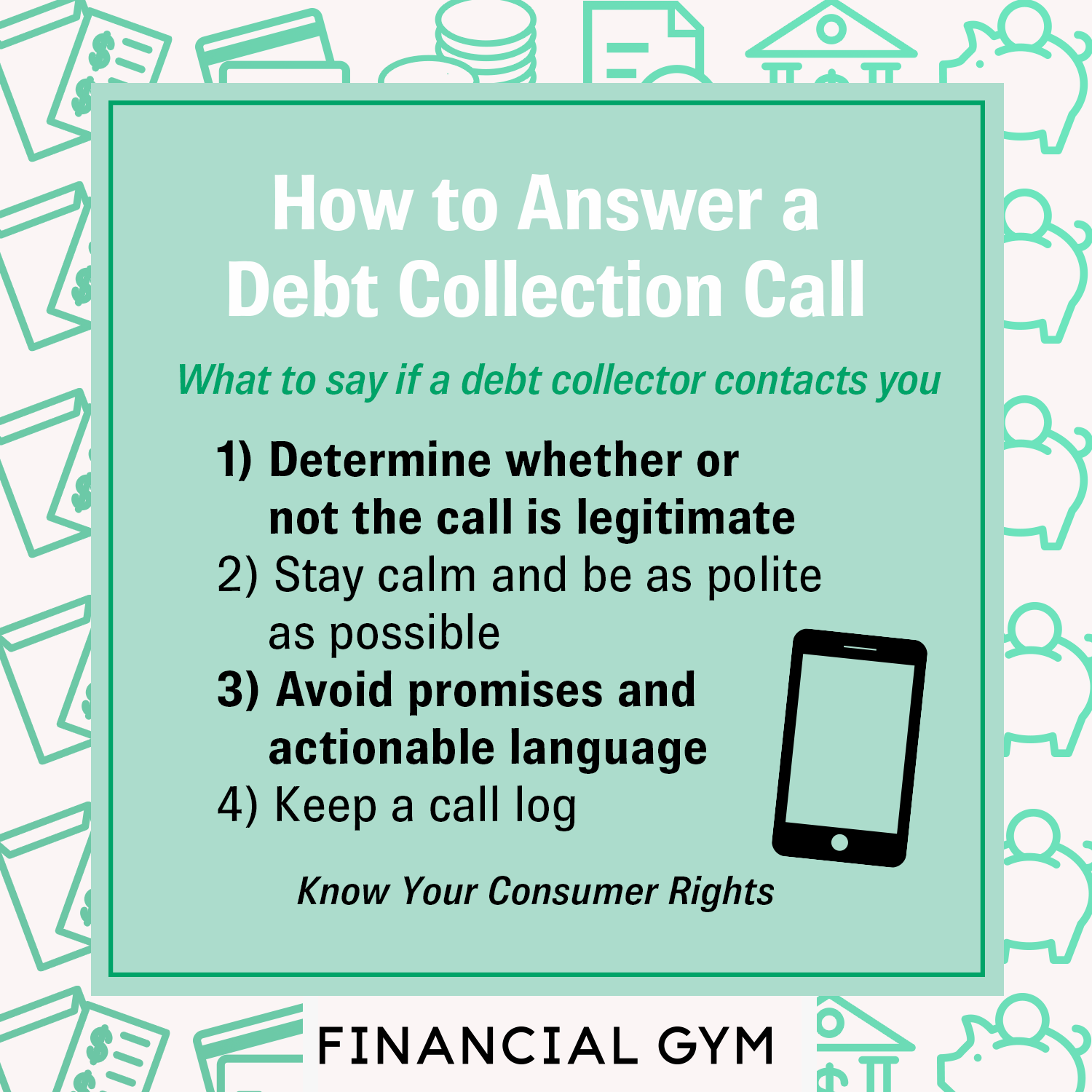

The FDCPA legally establishes what debt collectors can as well as can not do. top article They have to tell you the amount of the financial debt owed, share information concerning your rights and discuss exactly how to challenge the financial debt. They can likewise sue you for settlement on a debt as long as the statute of constraints on it hasn't expired.